Big LEAPing

Here's the latest on the LEAP charter school tax screw up:

Camden Pride Charter School, part of the trio of charter schools under the Camden Charter School Network, and LEAP Academy University Charter School had their 501(c)(3) status revoked by the IRS in November 2010 and were notified about a year later of their failure to file Form 990 for three consecutive years. The schools' predicament became public a couple of weeks ago.LEAP's urgency to restore its status is to avoid losing the tax exemption on $8.5 million in bonds. In 2003, the Delaware River Port Authority issued LEAP the special-project bonds, guaranteed by Rutgers University, for construction of its high school. Part of the compliance requirements for the bonds is that after their issuance, the tax-exempt organization must remain a qualified 501(c)(3).Camden Pride is attempting to get clarity from the IRS and have a good record with its

Michael Doherty: New Jersey's Worst Senator

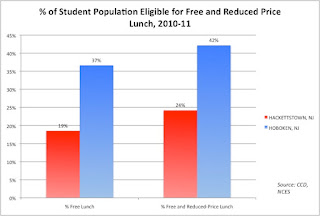

New Jersey State Senator Michael Doherty is obsessed with the idea that poor children might be getting "too much" money for their schools. Whenever he has a chance, he likes to raise the specter of fraud to make the case that school districts that serve more poor children should get more state aid. He has little idea of the mechanics involved in auditing free/reduced lunch program participation, but that never stops him from whiningthat poor children in the cities are living the high life while the 'burbs keep getting screwed.

So no one should have been surprised when, once again, he claimed the former Abbott districts are ripping off

So no one should have been surprised when, once again, he claimed the former Abbott districts are ripping off