OP-ED: A MESSAGE TO CONGRESS — KEEP CHARITIES AND FOUNDATIONS NONPARTISAN

Removing the longstanding ban on partisan political activity by charitable and philanthropic organizations presents a severe threat to the integrity and wellbeing of those organizations

- Nina Stack and Linda M. Czipo

Among the many ideas being considered as part of tax reform discussions in Congress is one that would remove the longstanding ban on partisan political activity by charitable and philanthropic organizations. This proposal presents a severe threat to the integrity and well-being of charitable and philanthropic organizations, and Congress should not allow it to proceed.

Since 1954, tax law has contained a provision prohibiting 501(c)(3) organizations from directly or indirectly attempting to influence the election or defeat of any candidate for public office. This ban, also known as the Johnson Amendment for its sponsor, then-Senator Lyndon B. Johnson, applies not only to churches but to all 501(c)(3) organizations including public charities and private foundations.

President Trump has repeatedly called for a repeal of the 62-year-old ban, and several different bills have been introduced in Congress to weaken or completely rescind it. Like 4,500 nonprofits and allies across the country, the Center for Non-Profits and the Council of New Jersey Grantmakers strongly oppose repeal and support preserving the current law.

The current ban provides an important buffer between partisan politics and charitable or philanthropic works. A hallmark of the charitable and philanthropic communities is our ability to unify stakeholders and tackle important problems without regard to partisan labels. As the National Council of Nonprofits has pointed out, if the Johnson Amendment is repealed, charities risk becoming identified more with a specific political party and less as the problem-solvers they are.

Repeal would all but guarantee the infusion of “dark money” into charitable work and would undermine public trust in the integrity of charitable organizations and philanthropic institutions. “Dark money” refers to the use of noncharitable entities such as 501(c)(4), 501(c)(6), and other vehicles, for political contributions without the legal requirement to disclose the source of these donations. Under the existing law, 501(c)(3) organizations are barred from accepting or using funds for partisan political purposes (this is often a source of confusion among policy makers, press and the public who are unaware of the clear differences between 501(c)(3) public charities and noncharitable nonprofits).

If the Johnson Amendment is repealed, donors could turn charitable organizations into conduits to funnel contributions to political candidates and campaigns — and these contributions would be tax-deductible. Charities and foundations would also become vulnerable to untoward political pressures — for endorsements, campaign contributions, and other kinds of support — that would effectively divert scarce resources from public-benefit missions to partisan political purposes.

Donor privacy could be at risk. In the wake of the U.S. Supreme Court’s Citizens United ruling and the proliferation of political organizations such as 501(c)(4) entities, 527 political action committees and others, efforts have been mounting at the national and state levels to shine a bright light on money in politics by requiring identification of political donors. Donor privacy has long been considered sacrosanct in the charitable world, and precisely because of the existing ban on electioneering, there is a strong rationale for excluding 501(c)(3) organizations from the donor disclosure requirements targeted at political organizations and activities. If the Johnson Amendment were weakened or repealed, the distinction between 501(c)(3) organizations and political organizations would become effectively meaningless, and donor privacy harder to protect.

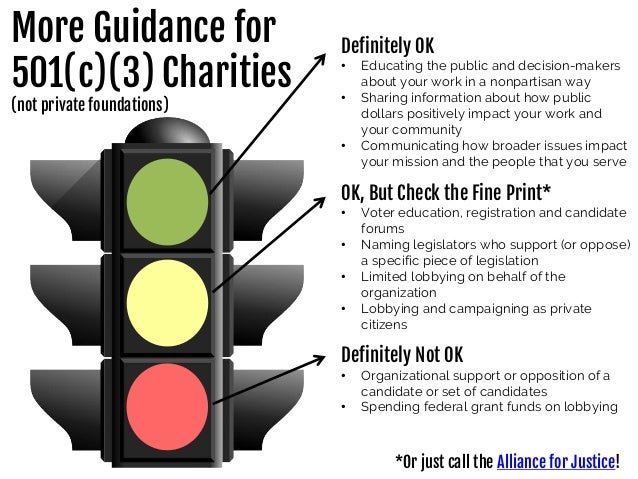

Nonprofit leaders can already speak out in their individual capacities. Proponents of repeal argue that it is needed on free speech grounds in order to allow religious leaders to express views about candidates and campaigns. But religious leaders, like any individual associated with a charity, are always free to make public statements endorsing or opposing candidates in elections — as long as they do so as individuals and not on behalf or in representation of the institution or with use of its resources. And current law already permits 501(c)(3) public charities (including houses of worship) and their representatives to engage in issue advocacy, limited lobbying, and voter engagement, all on a nonpartisan basis. It’s worth noting that numerous faith-based organizations have publicly opposed repeal as a dire threat to the integrity of their institutions.

Nonprofit advocacy is a critical part of public discourse and sound public policy. The current, longstanding ban on electioneering helps to preserve the integrity of, and trust in, charities and foundations, and also shields them from untoward pressures that could undermine their independent advocacy voice. Individuals who wish to endorse candidates should do so in their individual capacities, and organizations that wish to become involved in partisan politics should use one of the other vehicles, such as 501(c)(4), Section 527, or other noncharitable structures available for this purpose. Weakening the Johnson Amendment would cause incalculable damage to charitable and philanthropic organizations and to the public causes we serve. The current law should be preserved.