Divergent bond results for Chicago and Philadelphia schools

March 26 (Reuters) - Two of the nation's most distressed big-city school districts issued general obligation bonds this week, with very different results.

The junk-rated Philadelphia School District borrowed at investment-grade levels thanks to a state intercept program. But the higher-rated Chicago Board of Education paid a whopping 4 percent over the SIFMA Index on variable rate bonds - about five times more what it paid than two years ago.

On Tuesday, PNC Capital Markets and BMO Capital Markets priced two series of unlimited tax GO refunding bonds totaling $178.1 million for the Chicago school district.

The bonds priced "like distressed merchandise," said Municipal Market Data analyst Randy Smolik. The initial 4 percent over SIFMA floating rate is locked in for two years, according to the official statement.

Two years ago, the district's bonds were priced at only 75 basis points and 83 basis points over SIFMA.

All three Wall Street credit rating agencies downgraded Chicago schools in March, with Fitch Ratings and Moody's Investors Service knocking it down several notches, to one notch above junk.

The school system, the nation's third largest, also plans to sell about $372 million of new and refunding GO bonds.

"We continue to watch the market for the best time to price the next series of bonds," school spokesman Bill McCaffrey said.

The district is facing a structural budget deficit, diminished liquidity, big pension liabilities, high debt levels and the prospect of difficult negotiations with the Chicago Teachers Union.

Philadelphia's school system, the eighth biggest in the country, is also in financial crisis, due in part to rapid charter school growth.

Last fall, both Fitch and Moody's cut the district deeper into speculative bond territory.

Yet the district priced $233.4 million of general obligation bonds on Wednesday with credit spreads that were lower by an average 5 to 6 basis points compared with its last borrowing two years ago, Phoenix Capital Partners principal Andre Allen told the School Reform Commission on Thursday.

The bonds themselves were rated A-plus because they are part of the Pennsylvania School Credit Enhancement Direct-Pay Intercept Program, which requires the state to withhold appropriations to pay bondholders directly if there is a debt service shortfall.

The overall price of the five-part GO deal, most of which was refunding, was 2.70 percent with a six-year average maturity. That's 95 basis points higher than A-rated six-year debt on MMD's benchmark scale, but the district said it saved nearly $33 million through the refinancing.

(Reporting by Hilary Russ in New York and Karen Pierog in Chicago; Editing by Leslie Adler)Divergent bond results for Chicago and Philadelphia schools - Yahoo Finance:

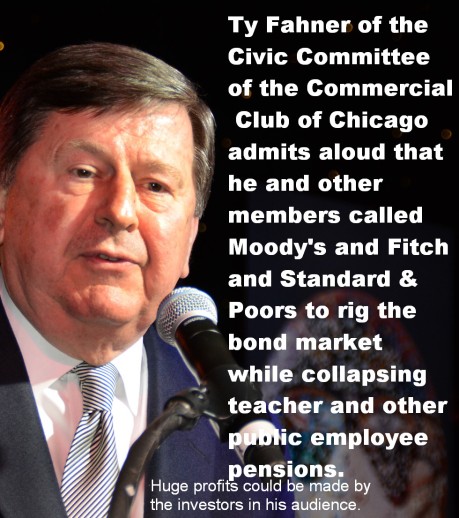

The writers: John Dillon on Ty Fahner’s evil deeds. | Fred Klonsky http://bit.ly/1BFa95z

Big Education Ape: Fitch Rates Sacramento City Unified School District JPFA, CA's LRBs 'A'; Outlook to Negative http://bit.ly/1cuobO0

Big Education Ape: Torlakson, Lockyer Caution Against Bonds - Year 2013 (CA Dept of Education) http://bit.ly/1BFbSrz

HEMLOCK ON THE ROCKS: MOODY WSJ assigns Aa2 to Los Angeles Unified School District's (CA) G.O. bonds....Big Busines... http://bit.ly/1BFccGP