John Dillon: Bruce Rauner and send in the clowns.

“No one should be surprised that Bruce Rauner set foot in the Illinois governor’s race recently by trampling all over the state’s working families. Despite the billionaire venture capitalist’s efforts to portray himself as a regular guy, he took a special pot shot at our union, which represents low-wage health care and child-care workers throughout Illinois. It was a glaring illustration of how little Rauner understands the plight of the state’s poor and working class.Our members earn low wages — sometimes poverty wages — and they don’t belong to the state

This is what Chicago democracy looks like. CPS students try to talk to the board and then tossed out.

A group of CPS students address the board about school closings and budget cuts. At 1:57 all hell breaks loose.

Popout

Popout

Pensions and the bond ratings. A bunch of hooey.

Capitalfax’s Rich Miller posts today that “apparently it wasn’t much of a catastrophe.”

He’s referring back to the near hysteria that broke out among legislators, pundits and editorial writers when, following the failure of the General Assembly to destroy public employee pensions, the rating agencies down-graded Illinois’ credit rating.

As Miller points out today, investor’s lined up to buy Illinois bonds and those of local municipalities anyway.

Does Illinois – and Illinois taxpayers – have to pay more in interest? Yes. But not nearly what the fear-mongers were predicting.

The fact is, what does an investor who is buying state bonds really care about Illinois pensions?

Guess who is constitutionally guaranteed to be paid, even ahead of public employee and their pensions.

Capitalfax’s Rich Miller posts today that “apparently it wasn’t much of a catastrophe.”

He’s referring back to the near hysteria that broke out among legislators, pundits and editorial writers when, following the failure of the General Assembly to destroy public employee pensions, the rating agencies down-graded Illinois’ credit rating.

As Miller points out today, investor’s lined up to buy Illinois bonds and those of local municipalities anyway.

Does Illinois – and Illinois taxpayers – have to pay more in interest? Yes. But not nearly what the fear-mongers were predicting.

The fact is, what does an investor who is buying state bonds really care about Illinois pensions?

Guess who is constitutionally guaranteed to be paid, even ahead of public employee and their pensions.

He’s referring back to the near hysteria that broke out among legislators, pundits and editorial writers when, following the failure of the General Assembly to destroy public employee pensions, the rating agencies down-graded Illinois’ credit rating.

As Miller points out today, investor’s lined up to buy Illinois bonds and those of local municipalities anyway.

Does Illinois – and Illinois taxpayers – have to pay more in interest? Yes. But not nearly what the fear-mongers were predicting.

The fact is, what does an investor who is buying state bonds really care about Illinois pensions?

Guess who is constitutionally guaranteed to be paid, even ahead of public employee and their pensions.

Pension “Committee of Ten” meets tomorrow in Chicago. Come on down.

After Governor Squeezy’s failed attempt at forcing a pension bill out of the legislature a few weeks ago, The Madman and Senate President Cullerton set up a Committee of Ten to try and reach a compromise between the House’s horrible SB1 and the Senate’s SB24o4. SB2404 was the bill that was supported by the We Are Onecoalition of state public employee unions.

By most accounts and predictions, nobody really expects SB1, or anything like it, it survive a court challenge.

There is less certainty about SB2404. But SB2404 no longer looks like it has a future life. Not because I opposed it, Lord knows. But because The Madman, out of his own political self-interest, wouldn’t let it come to a vote in the House.

The concern is that any compromise coming from this Committee – a Committee heavy with pension bombers – may still look a lot like SB1.

Tomorrow, Thursday, the Committee of Ten will meet in open session.

It is legislative committee that is charged with developing a pension proposal capable of passing both the Illinois House and Senate.

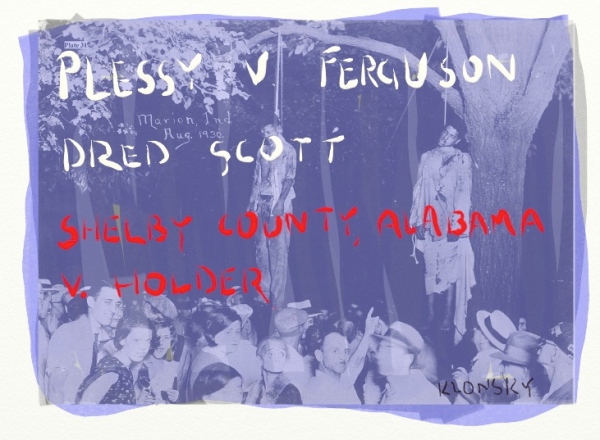

Ten minute drawing. American law.

By most accounts and predictions, nobody really expects SB1, or anything like it, it survive a court challenge.

There is less certainty about SB2404. But SB2404 no longer looks like it has a future life. Not because I opposed it, Lord knows. But because The Madman, out of his own political self-interest, wouldn’t let it come to a vote in the House.

The concern is that any compromise coming from this Committee – a Committee heavy with pension bombers – may still look a lot like SB1.

Tomorrow, Thursday, the Committee of Ten will meet in open session.

It is legislative committee that is charged with developing a pension proposal capable of passing both the Illinois House and Senate.