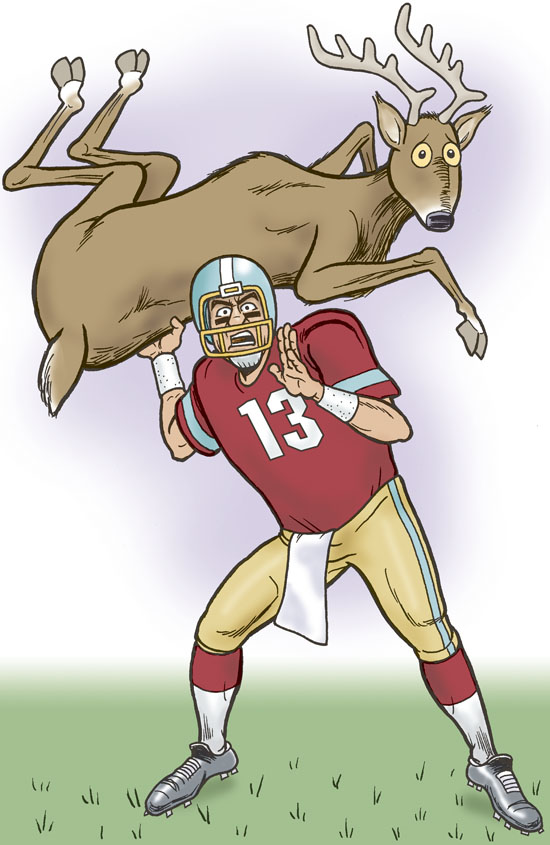

More Passing of the Buck

Another thing I never have time to say is this:

The cost-shift of the pension system is another exercise in magical thinking. Illinois already has a cost-shifted school district--- the Chicago Public Schools, even though the state still makes a contribution..

So what happens when the cost is shifted? The individual district uses the pension fund as a credit card, and doesn't pay in, just like the spineless legislature. Did you ever read this?

The cost-shift of the pension system is another exercise in magical thinking. Illinois already has a cost-shifted school district--- the Chicago Public Schools, even though the state still makes a contribution..

So what happens when the cost is shifted? The individual district uses the pension fund as a credit card, and doesn't pay in, just like the spineless legislature. Did you ever read this?

In May 1995, CPS sought and received a change in Illinois law which allowed it to keep pension tax revenue. Since 1996, this costly measure has redirected more than $2.3 billion in tax funds designated for pensions into the CPS operating budget. During the period 1996-2005, CPS received $1.2 billion in pension tax revenue, but contributed $0 to the Fund.There are hundreds of school district in this state, and each one will be lobbying for legal cover so that they can