Trump’s Student Debt Policies Are Mind-bogglingly Corrupt

The Republican Party’s economic policies have grown so corrupt and regressive as to be literally unbelievable. In focus groups, Democratic operatives have found that swing voters will often dismiss simple descriptions of the GOP’s self-avowed fiscal priorities as partisan attacks — after all, how could any major political party actually favor slashing Medicare benefits to lower taxes on the one percent?

Alas, a plain recitation of the Trump administration’s agenda on student debt is sure to strike many Americans as even more implausible.

But before we examine the president’s (absurdly corrupt) “college affordability” policies, let’s take a quick tour of the crisis that he inherited.

In the United States today, 44 million people carry $1.4 trillion in student debt. That giant pile of financial obligations isn’t just a burden on individual borrowers, but on the nation’s entire economy. The concomitant rise in the cost of college tuition — and stagnation of entry-level wages for college graduates — has depressed the purchasing power of a broad, and growing, part of the labor force. Many of these workers are struggling to keep their heads above water; recent research suggests that 11 percent of aggregate student-loan debt is more than 90 days past due or delinquent. Other borrowers are unable to invest in a home, vehicle, or start a family (and engage in all the myriad acts of consumption that go with that).

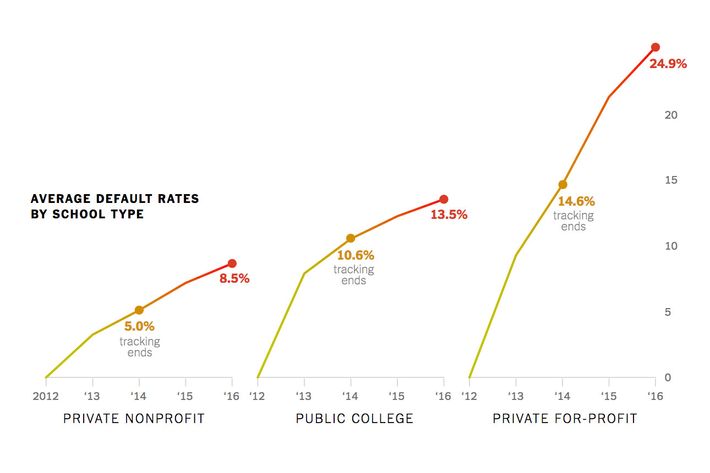

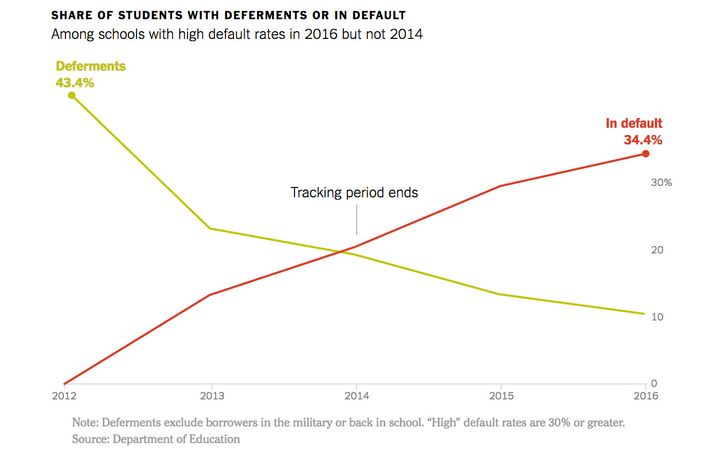

The full scale of this disaster is still coming into view. Just this week, the Center for American Progress (CAP) revealed that official government statistics have been hiding the depths of our student-debt problem. Federal law requires colleges that participate in student-loan programs to keep their borrowers’ default rates under 30 percent for three years after they begin repayment. But once those three years are up, federal tracking ends. Using a Freedom of Information Act request, CAP’s Ben Miller secured never-before-released data on what happens to default rates after Uncle Sam stops watching.

He found that many colleges (especially for-profit ones) have been artificially depressing their default rates during the three-year window by showering their borrowers in deferments — essentially, special allowances that empower debtors to temporarily stop making debt payments without going into delinquency. After the three years are up, the deferments disappear — and the default rates skyrocket.

Photo: Department of Education

Photo: Department of Education

Just about all of America’s institutions of higher learning are complicit in this sorry state of affairs. But for-profit colleges have been far and away the most malevolent actors. The entrepreneurs behind such schools looked at Continue reading: CFPB’s Student Loan Watchdog Resigns In Protest of Trump

How Betsy DeVos could trigger another financial meltdown - The Washington Post - https://www.washingtonpost.com/opinions/2018/08/29/how-betsy-devos-could-trigger-another-financial-meltdown/?utm_term=.8ec158e9ea36Betsy DeVos's Program Scorecard Isn't Going To Work - https://www.forbes.com/sites/dereknewton/2018/08/28/betsy-devoss-program-scorecard-isnt-going-to-work/#6a4a25ee4418 by @dereknewton on @forbes