In 2012-13, the State of California introduced a new way of financing K-12 education with the introduction of the Local Control Funding Formula (LCFF). It was implemented beginning in the 2013-14 school year.

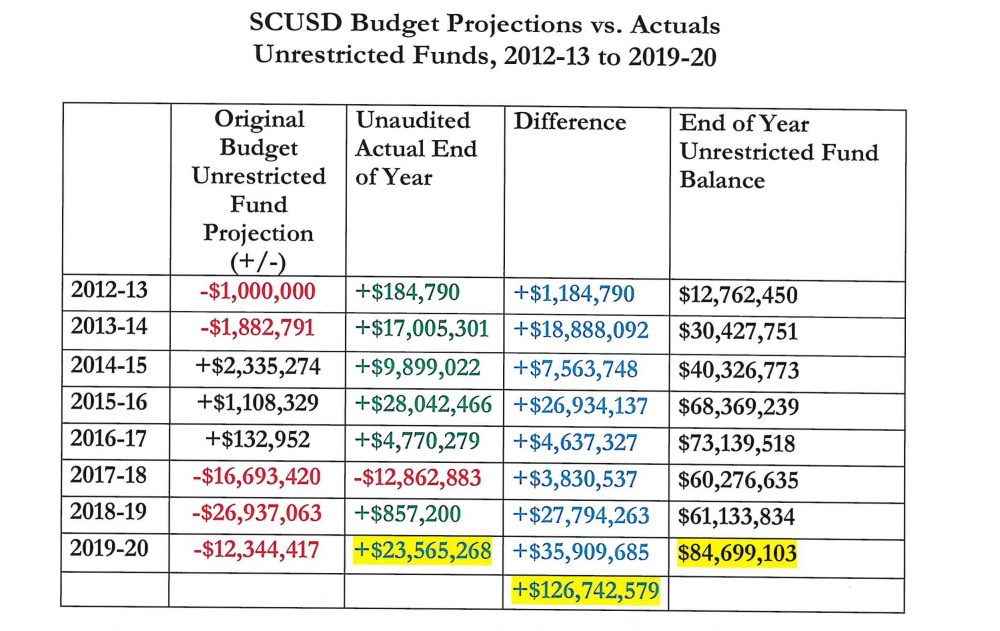

A look at the budget projections of the Sacramento City Unified School District (SCUSD) one year prior to the implementation of LCFF, and the seven years since, demonstrates SCUSD’s a clear and consistent pattern of grossly inaccurate budget projections.

In California, school districts are required by law to submit three budgets during a fiscal year. The Original Budget is submitted in July, the First Interim Budget in December, and the Second Interim Budget in March. At the conclusion of the year, a districts actual performance is released in September as its “Unaudited Actuals.” Chart 1 looks at the SCUSD Original, July 1, budgets for 2012-13 and compares them to Unaudited Actuals for that same year.

School districts of the size of SCUSD are also required a minimum Unrestricted Cash Balance Reserve of 2% of its expenditures. For 2019-20, the 2% represented $11.9 million.

It is worth noting, that in the last eight years, SCUSD ended with a deficit only in 2017-18. Ironically, in December of that same year, the Sacramento County Office of Education strongly advised District administrators to reduce expenses by $15.7 million during the remainder of that school year. SCUSD ignored the SCOE recommendation, and instead actually increased its unbudgeted unrestricted fund spending including on the following:

- A $6 million vacation buyout for top administrators;

- The introduction of a poorly planned and administered Summer School Program;

- The additional of 18 unbudgeted administrative positions;

This led to SCOE rejecting the SCUSD 2018-19 budget, the first time in SCOE’s history a Sacramento County school district has had its budget rejected. Since then, SCOE has rejected three additional SCUSD budgets.

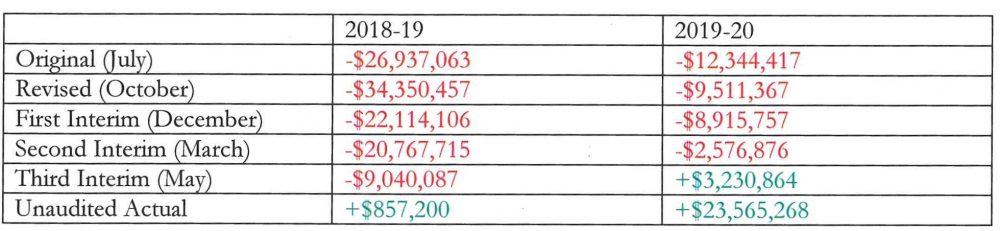

Chart 2 looks at the inaccuracy of SCUSD budget projections for the last two school years—even with a SCOE-appointed Fiscal Advisor helping to administer SCUSD finances—since SCOE first rejected the SCUSD budget. Because SCUSD budget was rejected, it is required to submit a Third Interim Budget in May.

Throughout 2018-19, SCUSD claimed to be on the brink of insolvency. It ended the year with a unrestricted fund surplus. Again in 2019-20, SCUSD still claimed to be on the brink of insolvency and projected a $12 million deficit for the year. With six weeks remaining in the fiscal year, the District now projects a $3.2 million surplus—a $15.5 million turnaround, which might be noteworthy except that it is consistent with the District’s budgeting practices for at least the last eight years.

2019-20 was even more extreme. SCUSD started the fiscal year projected a $12.3 million deficit. It ended the year with a $23.6 million surplus, a difference of $35.9 million. SCUSD’s unrestricted reserve fund now is $84,699,103 and its total unrestricted/unrestricted reserve fund is $93,048,611, the highest in SCUSD history. It is worth noting that SCUSD’s Third Interim Budget which was released in May 2020 with fewer than six weeks remaining in the fiscal year underestimated the District end of the year surplus by over $20 million.