Bankers and Teachers: Scandals and Accountability (Part 1)

Wells Fargo, a bank that made more than $80 billion in revenue and has amarket value of $277 billion, was fined $185,000,000 by federal regulators for creating 1.5 million fake credit card accounts. In the plea bargain that regulators made with bank officials, Wells Fargo admitted no responsibility for the financial misconduct. The company had fired more than 5,000 of their lowest-paid employees but neither the senior vice-president for community banking where the fraud occurred nor the CEO lost their positions. CEO John Stumpf, named in 2013 as Morningstar’s CEO of the Year and earning about $20 million a year, did face U.S. Senate Banking Committee questions about the phony accounts last week. In testimony, the CEO did say “I take full responsibility for all of the unethical practices in our retail banking business.”A member of the Banking Committee, Senator Elizabeth Warren (Dem.-Mass) said what the bank did was a “scam” and that Stumpf “should resign… and you should be criminally investigated.”

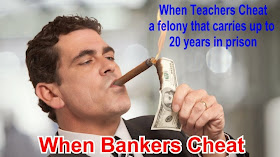

Looking back at the fallout from the Great Recession of 2008 in lost billions of investors’ dollars, millions of home foreclosures, and crushed hopes of a generation of hard-working American retirees–apart from one senior trader at Credit Suisse who was convicted and served 30 months—not one single CEO of an investment house, bank or insurance company hip-deep in deceiving and defrauding Americans was indicted or served a day in jail. Yes, federal regulators fined other banks like JPMorgan Chase and Bank of America billions of dollars but they like Wells Fargo admitted no unlawful conduct and took no responsibility for their actions (see here, here, here, and here). Contrast that with the savings-and-loan bank failure in the 1980s when over 1,000 bankers went to jail for fraud and similar charges. That was then, this is now.

Immunity from accountability is currently widespread in the private sector. But not in the public sector.

Take the case of the Atlanta Public Schools and the cheating scandal between 2009-2015. Superintendent Beverly Hall led the district between 1999 and 2010. In 2009, she was named Superintendent of the Year by the American Association of School Administrators. After an investigation by state officials in 2011 triggered by the Atlanta Journal-Constitution revelations in 2009 that nearly 180 teachers and officials in 44 schools raised students’ test scores, Hall and 31 teachers and administrators were indicted and stood trial. Most of these Bankers and Teachers: Scandals and Accountability (Part 1) | Larry Cuban on School Reform and Classroom Practice: