ITEP’ing the Scale: Part 1

Despite enormous push back and passionate testimony from citizens, on Friday, December 14th, the Louisiana Board of Commerce and Industry approved what is arguably the largest property tax exemption ever granted in the nation. Tellurian Inc., the applicant of the Industrial Tax Exemption Program (ITEP), could potentially be relieved of two billion dollars in property tax liability for its planned project, Driftwood LNG. A representative of Tellurian expressed a dire need to receive the exemption for the project to move forward without providing much detail. You can read more about the reasons by clicking this link.

I’ll bet you’re wondering. What is ITEP? Why is it needed? Why the push back from the public? To answer the first question, ITEP is a state program designed to entice businesses into locating in Louisiana by offering incentives. In this case, relief from paying ad valorem taxes, also referred to as property taxes. The reason ITEP is needed is because states compete with each other to draw business and industry. The states along the Gulf coast are particularly competitive when it comes to large industries that do business nationally, or worldwide, and need access to ports, waterways and railways. These locations also have large populations of employable blue-collar workers, which is beneficial to both the businesses and the communities.

The primary reason for public push back is simple. In general, the people are tired of being asked to approve tax propositions CONTINUE READING: ITEP’ing the Scale: Part 1 – Educate Louisiana

In Part 1 of this blog, I explained the Industrial Tax Exemption Program (ITEP) and how it tilts the economy in favor of business/industry. In the closing, I stated that returning the economy to a more balanced state isn’t as simple as reining in ITEP. I hope to explain my reasoning, here, in Part two.

To illustrate, I’m going to stick with things that are specific to Calcasieu parish, which is where I live, and how it applies to K-12 education, which is where I work. What I am going to explain can be observed in what are considered to be Louisiana’s richest parishes; Jefferson, East Baton Rouge, St. Tammany, Caddo, Calcasieu, and an anomaly in Cameron.

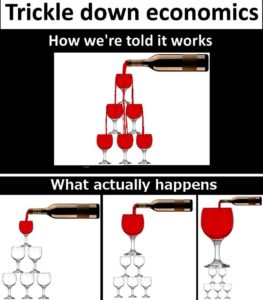

Louisiana’s economy is a living example of what you would call “trickle-down” economics. There are many different economic theories, and in general, they tend to favor business to varying degrees. Any theory that attempts to balance its benefits equally between business and citizens is generally denounced as anti-business, or socialism. Trickle-down economics is a conservative, or Republican, ideal that mostly came to light under President Reagan. The general idea behind trickle-down is that when businesses are free of government restraints, they are able to increase profits, reinvest in their business, hire more people; therefore, creating a thriving economy. In order to accomplish this, there has to be a reduction in government’s reliance on tax revenue. This is generally done through business exemptions on income and property; however, like most theories, it doesn’t play out as well in CONTINUE READING: ITEP’ing the Scale: Part 2