New CEEP report analyzes how school vouchers are funded

Report presents in-depth analysis of funding for private K-12 schools and its impact on public education finance

BLOOMINGTON, Ind. -- A new publication from the Center for Evaluation & Education Policy at the Indiana University School of Education compares the funding mechanisms of school voucher programs in Arizona, Indiana, Louisiana, Ohio, Wisconsin and the District of Columbia and the interaction of these mechanisms with overarching school funding formulas.

The cross-case review is part of a larger report, including detailed profiles of each individual case and data visualizations.

The publication, "Follow the Money: A Comprehensive Review of the Funding Mechanisms of Voucher Programs in Six Cases," examines the impact of policies on voucher funding, contrasts eligibility criteria and considers the impact of these criteria on state spending and district revenues. The review is co-authored by CEEP research associate Molly S. Stewart and graduate research assistant Jodi S. Moon.

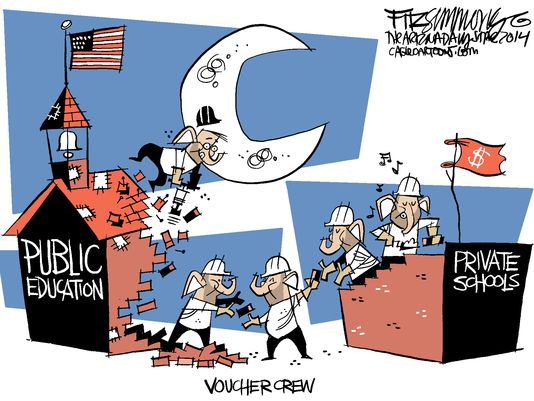

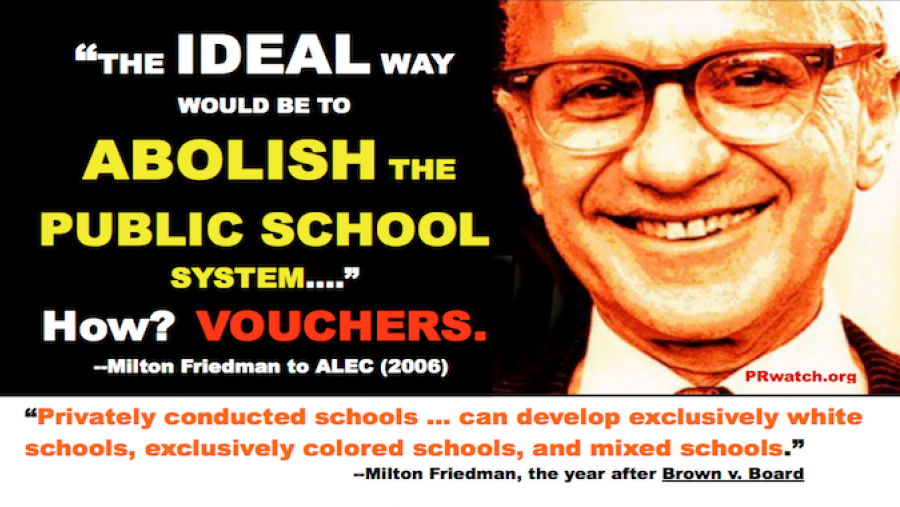

The methods of funding school vouchers are of particular policy concern since they entail using government money to pay tuition to private schools. Publicly funded voucher programs -- money awarded to a student for the purpose of private school tuition -- have become considerably more prevalent in recent years. The funding design of each voucher program differs, and each program interacts with its respective state-level school funding formula to create a variety of impacts on funding sources such as state aid and local district tax revenues.

“The impacts on state and local expenditures and revenues are more complex than previous aggregate economic analyses have suggested,” Stewart said. “Policymakers need to be aware of how specific voucher policy designs can impact funding at multiple levels.”

Moon said, “The way a school district’s student count interacts with voucher funding varies depending on the state’s policy regarding how school enrollment is counted, and the available data allow us to unpack these relationships in most cases. The impact is less clear as it pertains to the relationship between student counts and categorical funding, such as special education and poverty-based assistance. We believe more research is warranted in this area.”

The review provides cross-case findings and conclusions about the financial impacts of different voucher programs, conceptual background on how public school systems and voucher programs are funded, and detail on the study methodology and limitations.

Key findings regarding the impact of voucher programs on public education finance fall into three primary categories:

- Savings and/or losses at the state and local levels.

- The impact of enrollment and student count, including categorical funding and weights based on student characteristics.

- Fiscal accountability policies.

These three categories in the data demonstrate how finance policies interact with each other to create fiscal impacts that are significantly more complex than the savings calculations employed by most other research on voucher finance.

Public accountability and transparency are issues even in terms of access to primary data sources.

“We find a wide variation in the availability of data across our cases,” Stewart said. “While this is perhaps in part due to limitations of federal privacy law, the level of available, detailed information in some cases as compared to others suggests that federal privacy law is not the limiting factor in data availability, which means that government entities could likely be more transparent when it comes to publishing school voucher data.

"We also find variance in the accountability policies and monitoring practices across states, with some requiring minimal monitoring and weak enforcement mechanisms and others requiring a high level of transparency and strong enforcement of fiscal accountability policies. Given that these programs are publicly funded, and that taxpayers have an interest in knowing how their tax revenues are being used, this is of note.”

In terms of policymaking and political support, the policy details of voucher programs are highly significant. Policymakers should understand the potential impact that the school voucher provisions they make can have on state and local revenues, the authors say. This in turn should help them make informed decisions about whether a voucher program design meets their individual or constituents’ expectations.

About Center for Evaluation & Education Policy

One of the country's leading nonpartisan program evaluation and education policy research centers, the Center for Evaluation & Education Policy promotes and supports rigorous evaluation and research primarily, but not exclusively, for educational, human services and nonprofit organizations and agencies. Center projects address state, national and international education questions. CEEP is part of the Indiana University School of Education.

New CEEP report analyzes how school vouchers are funded: IU Bloomington Newsroom: Indiana University Bloomington: