Q:

What is the difference between a private foundation and a public charity?

A:

Private foundations

Foundation Center defines a private foundation as a nongovernmental, nonprofit organization having a principal fund managed by its own trustees or directors. Private foundations maintain or aid charitable, educational, religious, or other activities serving the public good, primarily through the making of grants to other nonprofit organizations.

Every U.S. and foreign charity that qualifies under Section 501(c)(3) of the Internal Revenue Service Code as tax-exempt is a "private foundation" unless it demonstrates to the IRS that it has met the public support test. Broadly speaking, organizations that are not private foundations are public charities as described in the Internal Revenue Service Code.

Public charities

Public charities generally derive their funding or support primarily from the general public, receiving grants from individuals, government, and private foundations. Although some public charities engage in grantmaking activities, most conduct direct service or other tax-exempt activities. A private foundation, on the other hand, usually derives its principal fund from a single source, such as an individual, family, or corporation, and more often than not is a grantmaker. A private foundation does not solicit funds from the public.

Why should grantseekers know the difference?

Examining a funder's giving history is an important part of researching foundation prospects. Past grants can reveal the funder's preferred subjects, organization types, and ranges of grant amounts.

This data is easier to get from a private foundation, which must disclose all grantees and grant amounts in its IRS Form 990-PF. However, a grantmaking public charity isn't subject to this disclosure requirement, so access to its grants data will depend on how much the funder is willing to share with the public, via its Form 990, website, or other communication channels.

If a grantmaking public charity doesn't provide a grants list in its Form 990, explore its website or search the Internet for the funder's name to find any related news or press releases, some of which may be about grants that it made.

A word about "foundation"

Don't assume that an organization with "foundation" in its name is a grantmaker. (Example: Foundation Center.) The word "foundation" has no legal definition.

Selected resources below might also be helpful.

Web Sites

* indicates staff pick

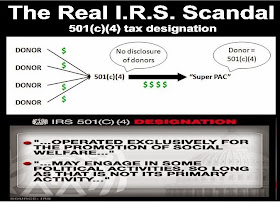

Types of Organizations Exempt under Section 501(c)(4)

Internal Revenue Code section 501(c)(4) provides for the exemption of two very different types of organizations with their own distinct qualification requirements. They are:

- Social welfare organizations: Civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare, and

- Local associations of employees, the membership of which is limited to the employees of designated person(s) in a particular municipality, and the net earnings of which are devoted exclusively for the promotion of social welfare.

Homeowners associations and volunteer fire companies may be recognized as exempt as social welfare organizations if they meet the requirements for exemption. Organizations that engage in substantial lobbying activities sometimes also are classified as social welfare organizations.

Additional information

Social Welfare Organizations - Examples

Some nonprofit organizations that qualify as social welfare organizations include:

- An organization operating an airport that serves the general public in an area with no other airport and that is on land owned by a local government, which supervises the airport’s operation,

- A community association that works to improve public services, housing and residential parking; publishes a free community newspaper; sponsors a community sports league, holiday programs and meetings; and contracts with a private security service to patrol the community,

- A community association devoted to preserving the community’s traditions, architecture and appearance by representing it before the local legislature and administrative agencies in zoning, traffic and parking matters,

- An organization that tries to encourage industrial development and relieve unemployment in an area by making loans to businesses so they will relocate to the area and

- An organization that holds an annual festival of regional customs and traditions.

Action Organizations

Seeking legislation germane to the organization's programs is a permissible means of attaining social welfare purposes. Thus, a section 501(c)(4) social welfare organization may further its exempt purposes through lobbying as its sole or primary activity without jeopardizing its exempt status. An organization that has lost its section 501(c)(3) status due to substantial attempts to influence legislation may not thereafter qualify as a section 501(c)(4) organization. In addition, a section 501(c)(4) organization that engages in lobbying may be required to either provide notice to its members regarding the percentage of dues paid that are applicable to lobbying activities or pay aproxy tax . For more information, see Lobbying Issues .

Additional information

http://www.irs.gov/Charities-&-Non-Profits/Other-Non-Profits/Types-of-Organizations-Exempt-under-Section-501(c)(4)